The current administrations attacks on the “fossil fuel” industry have caused a sharp rise in gasoline prices. Traditional economics tells us that when the price of anything goes up, demand and use goes down. So Dave Dixon took a look at the last few years of gasoline use. You see the sharp drop during the early period of the epidemic followed by the rebound and then a decline as prices rose. Here is the practical consequence of this, aside from the acute financial pain to the majority of Americans who live paycheck to paycheck. This means parents who can’t drive their children to a park, or to visit friends or to engage in sports activities. It means families who can’t visit relatives or friends. It means people may be forced to take unsafe public transportations. It means less road trips, providing less revenue for resorts, hotels and restaurants.

Whacko progressive’s answer to this is to tell people to buy electric vehicles, which are incredibly expensive and which need electricity, the price of which is rising by double digits.

Dave’s notes:

Dave’s notes:

- The U.S. Energy Information Administration (EIA) publishes a wide variety of energy information. We were interested to see what gasoline demand might tell us about the state of the US economy, given high gasoline prices and negative GDP growth. One recent article published by the EIA (https://www.eia.gov/

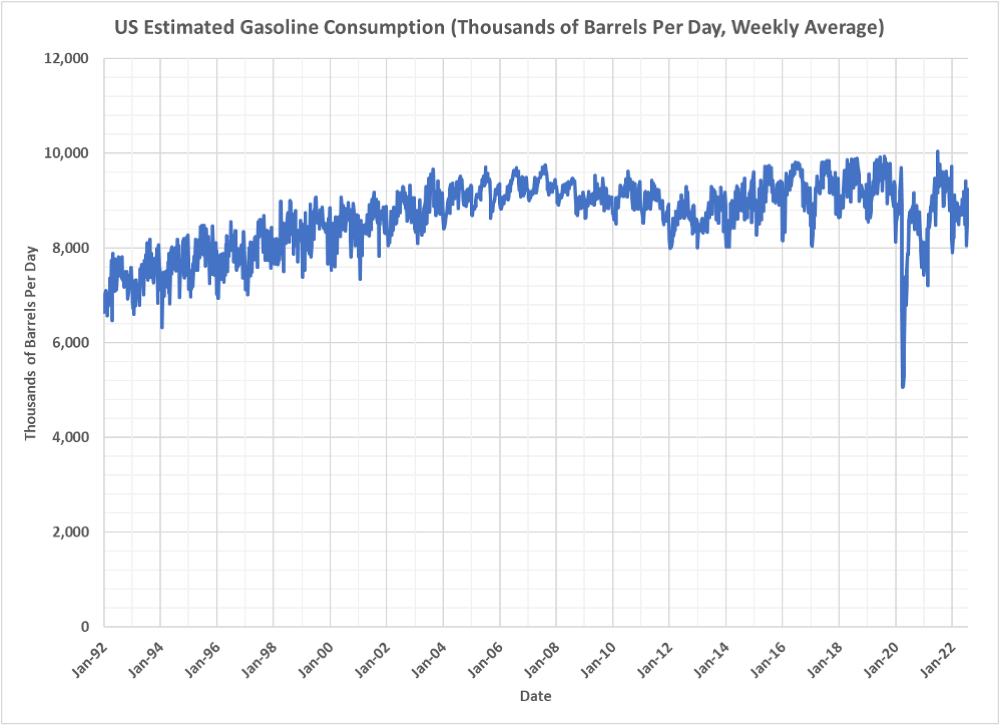

petroleum/weekly/archive/2022/ 220707/includes/analysis_ print.php) noted that current gasoline consumption had fallen below the consumption level seen in 2021, linking the drop in consumption to high prices. - Fig. 1 displays the estimated US gasoline demand, in thousands of barrels per day. The data is available from the EIA here: https://www.eia.gov/opendata/

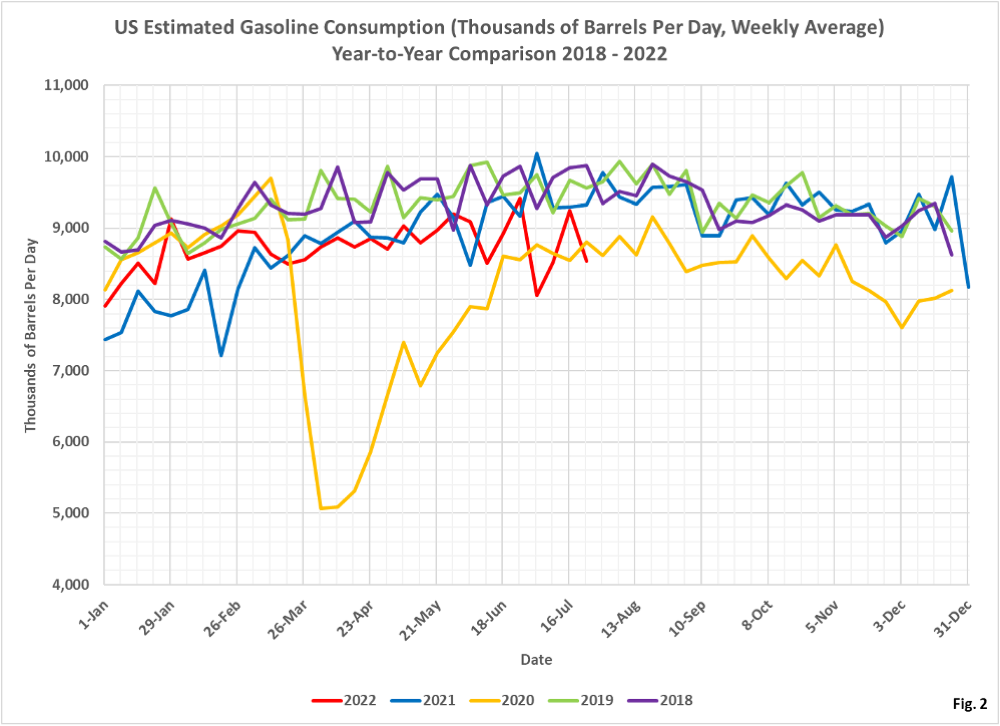

v1/qb.php?sdid=PET.WGFUPUS2.W. The parameter plotted is “U.S. Product Supplied of Finished Motor Gasoline, Weekly”. The EIA defines this variable as the approximate weekly consumption of gasoline, because it is a measure of the shipments of gasoline out of refineries, storage facilities, pipelines, etc. There are several interesting features in Fig. 1: 1). The general flattening and decline of the curve starting around 2006. 2). An increasing trend starting in 2014. 3). The dramatic drop in consumption in early 2020 during the first Covid shutdowns. 4). The recovery to pre-Covid consumption levels in mid-2021. 5). Decline in consumption in 2022. - Fig. 2 displays this same data as Fig. 1, but with the years 2018 through 2022 overlayed to make it easier to compare one year to the others. Here 2020 (gold curve) stands out for its decreased consumption, along with the first several months of 2021 (blue curve). The second half of 2021 appears almost identical to 2018 and 2019. Consumption in 2022 (red curve) started out to the pre-Covid years but then starting declining, and is now roughly the same as the same time in 2020.

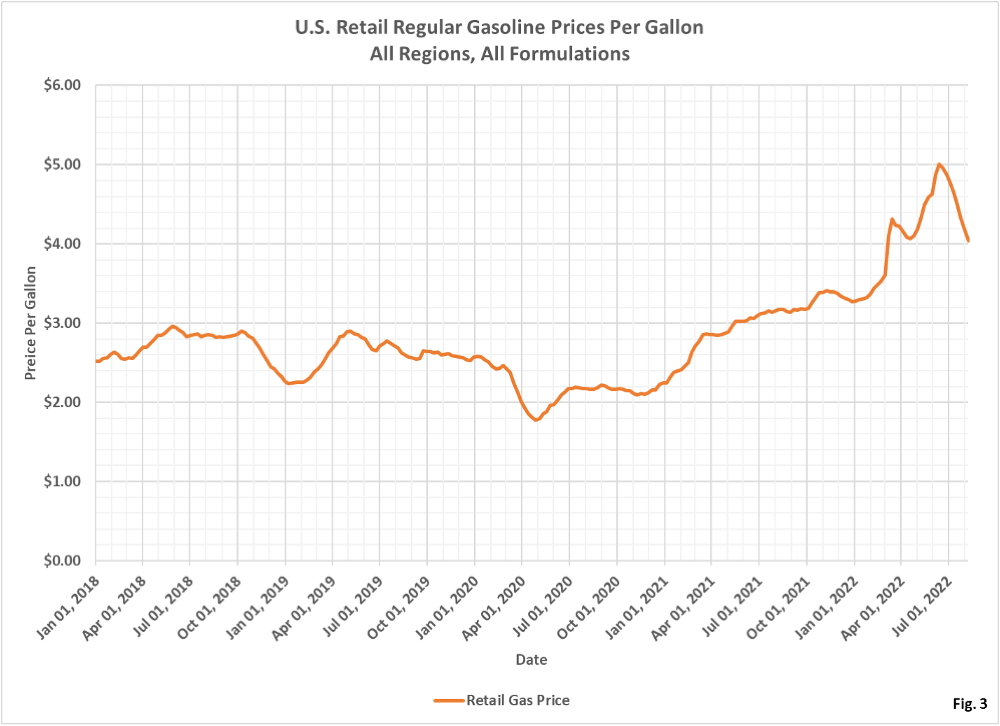

- Fig. 3 displays the average retail U.S. price per gallon for conventional and reformulated gasoline. The data was downloaded from this page https://www.eia.gov/petroleum/

gasdiesel/ using the link titled “full history”. The average US price per gallon peaked on approximately 6/20/2022, but we have yet to see consumption increase materially. If the decrease in demand is due to high prices then we should see demand increase, although there may be a lag before people’s behavior changes. However, if the decrease in demand is due to the overall decline in GDP in the first half of 2022, then it is possible that the decrease in prices is due to the decrease in demand.

I have been told by the current administration that it is not their fault that gas has risen so precipitously. I have also been told by the current administration that they now gotten gas under $4 on national average. Basically they cannot control when it goes up, but do have control to make it go down. (insert head scratching emoji)

And let us not forget that the significant role China plays in the manufacture of electric car batteries.

https://www.automotiveworld.com/articles/risky-business-the-hidden-costs-of-ev-battery-raw-materials/

US car registrations have gone up every year for the last decade at least. So this tells me that individually we are driving less when prices rise. Working from home, combining errands, car pooling, etc., what we should have been doing all along.

Regarding the current White House, none of these people are stupid. None of this is happening without calculated decisions. The WEF installed a compromised, senile, political hack who they have complete control over. We are getting exactly what the Globalists want, a weaken country, energy destruction and internal social chaos.

China is laughing all the way to the bank, knowing full well that there’s no future to the renewables when it comes to running a country with any manufacturing base. There’s this little issue of ‘Energy Density’ that physics dictates, regardless of what the MSM tells you. The more the West goes ‘Green’, the more leverage China has over our destiny. The faster it happens , the faster China takes control of our future.

History will show that Xi and Putin will be heroes for standing up to the WEF, gathering up the rest of the world that the US has abused and starting out on their own new energy and commodity independent path. The EU is on the brink of failure, one winter away from an energy collapse. Germany holds all of the EU debt, when it goes, so goes the rest of them. The WEF will continue to install its acolytes into as many failed EU countries as possible as they ‘Reset” the West.

The Republican party needs to declare the WEF as a Terrorist Organization and apply all of the tools available to lock down their funding and jail all government employees who area connected to them. Just like they were ISIS or Taliban, etc. We can’t allow this external group to determine our sovereignty and future.