I mentioned in the post on the CBO report on how bad our deficit and debt situation is that I expect that interest rates will stay high. Everyone ties interest rates primarily to inflation but that isn’t the sole or perhaps even primary factor. Demand and supply balance factors in any price decision and interest rates are the price of money or monetary instruments. At some point people will wonder if we can pay back our pile of debt and there will be less demand. But the inflation side is important and most people are unaware that various government entities have worked hard to minimize real-life inflation in the official statistics, by, as usual, re-defining how it is measured. Anyone who tracks climate statistics is familiar with this government trick. Don’t like what the temperature records tell you? Just change the numbers due to “adjustments”.

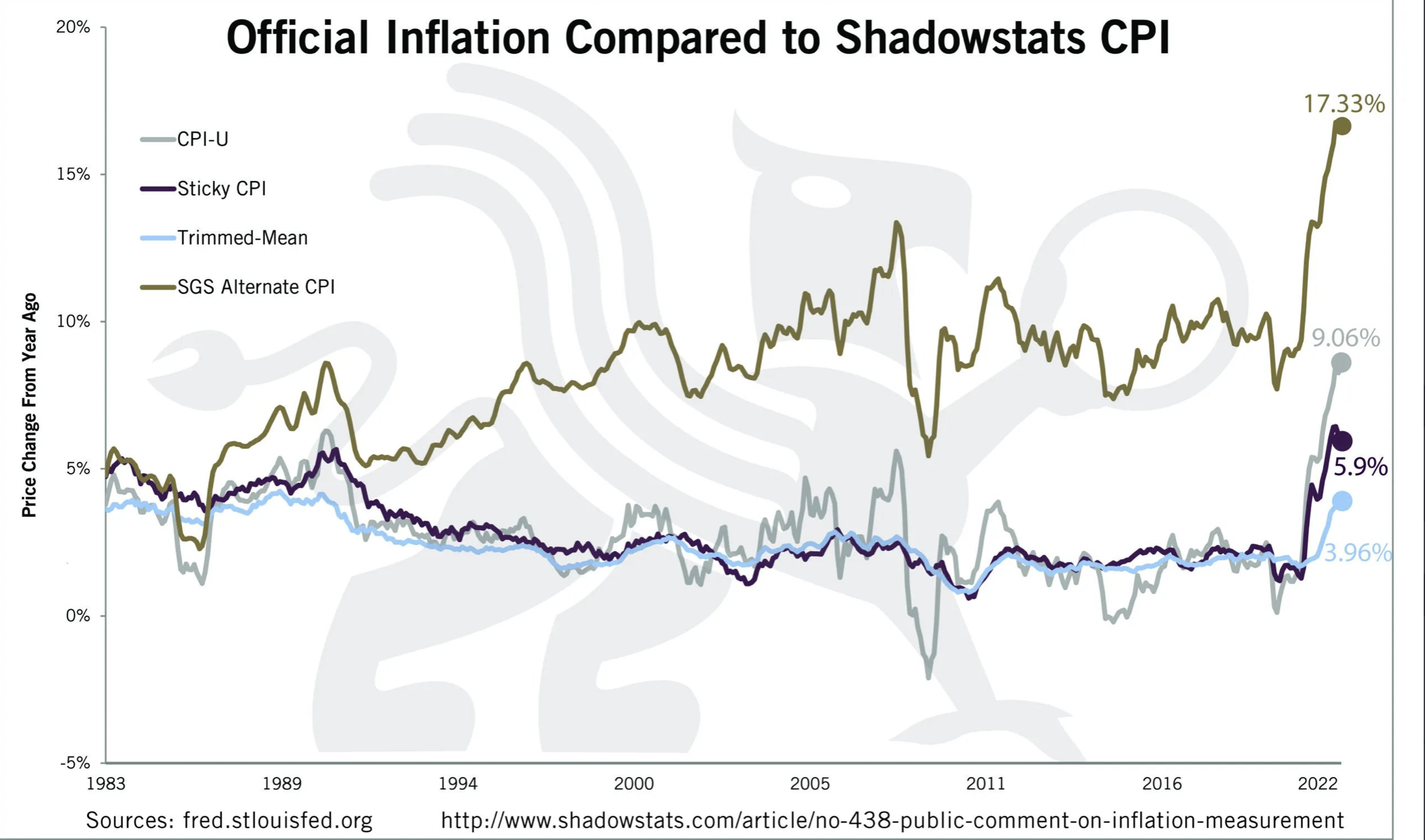

The chart below shows what inflation would look like if the way it is measured hadn’t changed. The website it comes from “shadowstats” is a great way to track government shenanigans on important statistics. If inflation was calculated now as it was in 1990, it would be running closer to 14%. Funny how all the adjustments over time just make it lower, meaning less adjustments for things like Social Security, tax brackets, etc. The fact that real inflation affecting most Americans has been much higher than reported explains some of the income and wealth gap and why that gap has grown. Rich people simply aren’t that affected by inflation and their wealth grows as asset prices rise. Anyway, as usual, question everything. (ShadowStats Site)