More excellent work from Dave Dixon. Diesel fuel is a lifeblood of the economy. Trucks use it to transport everything we buy, materials used in construction, equipment for businesses, and so on. The war on fossil fuels has taken a particular toll on the costs of diesel fuel and aided in raising the costs of everything else we buy.

Dave’s notes:

Dave’s notes:

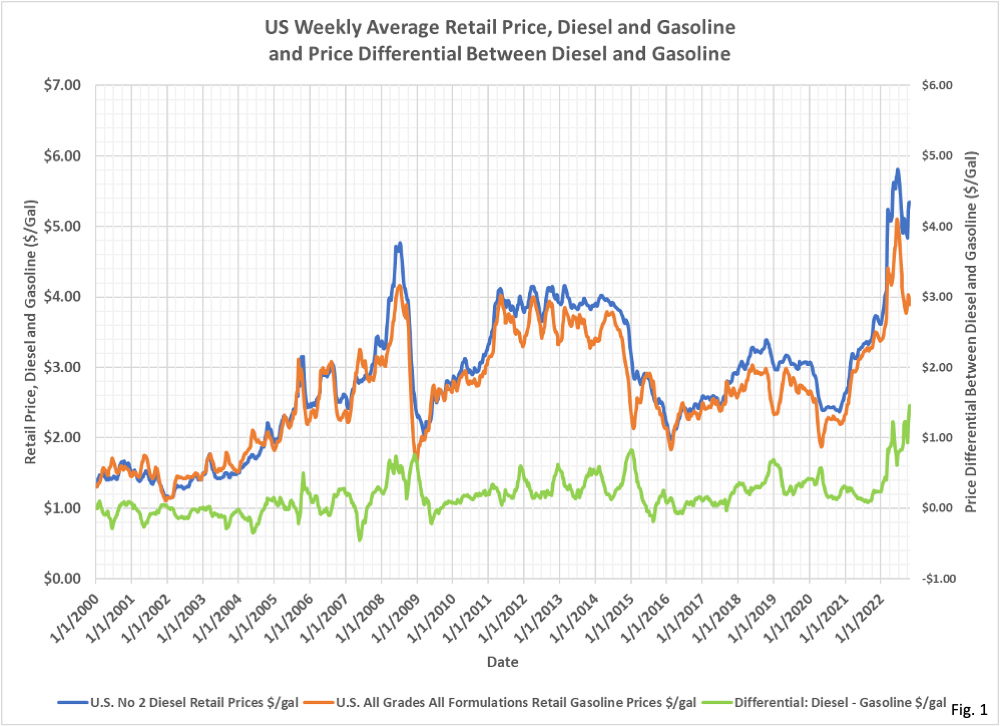

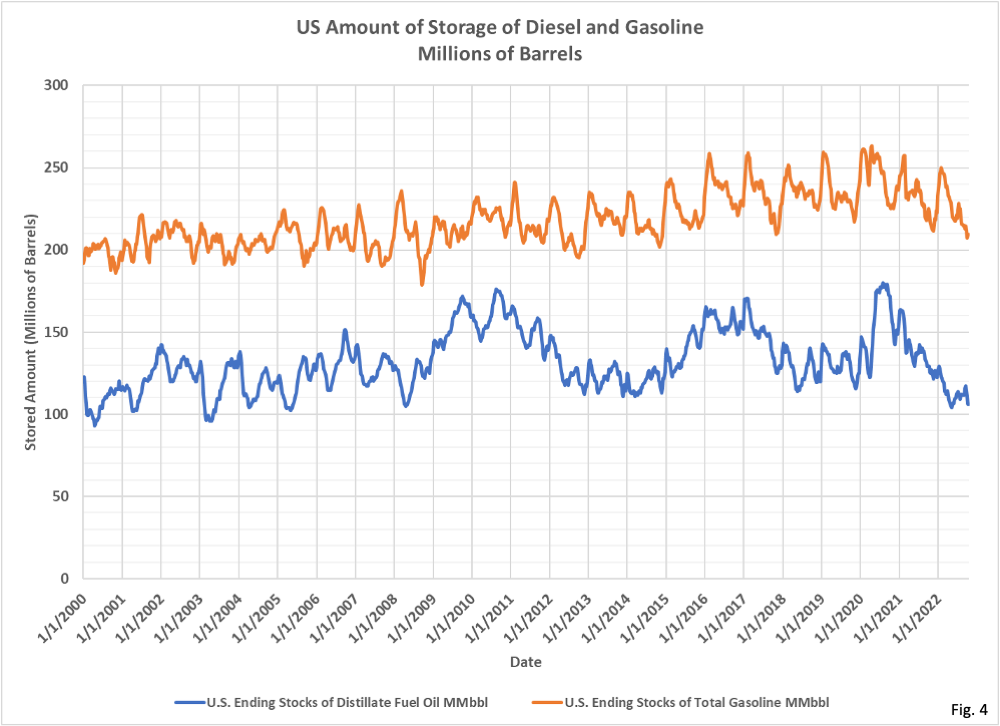

- Recent news reports have said that the price differential between the retail price of diesel fuel and gasoline has never been higher in the US. Other reports also state with alarm that there are only 25 days of diesel consumption in storage, raising concerns about potential disruption in the US transportation system (for example, here: https://mansfield.energy/market-news/supply-alert-october-25-2022/#msdynttrid=1qYzYrHWgKvSvvNMn2BMAWX41c_5cJ3IPRVBw_cJnE8). The charts above explore what is going on with motor vehicle fuel prices, consumption, storage, and refining. Diesel fuel, of course, is critical to transportation on commodities and goods by truck and rail, for food production on farms, and also for heating. Oil used for home heating primarily in the Northeast US, is the same basic product as diesel, with minor chemical composition differences. Home heating oil is taxed differently, and dyed red to discourage tax evasion. It appears that production is constrained, leading to reduced storage, and higher prices. The amount of storage is not much less than seen before, but perhaps given all the disruption in industry and transportation that this is enough to cause major supply disruptions and to cause prices to rise.

- Fig. 1, US Weekly Prices for Diesel and Gasoline: This chart shows the average US price for diesel fuel and gasoline, and the price differential between the two. The most recent average US price for diesel fuel is $5.34/gal, and for gasoline $3.89, with a differential between diesel and gasoline of $1.45/gal. As recently September 2021 the differential was only $0.10/gal. A search of the internet discusses reasons why diesel may be more expensive, such as higher refining costs due to sulfur pollution rules and differing tax rates. However, these cost drivers would have been present in 2021 as well when the price differential was quite small, so there must be other factors at work. Demand is also a possible contributor to higher diesel prices, which we will examine in Fig. 3. Note also that while gasoline has fallen by $1.22/gal since the peak prices last summer, diesel prices have only fallen $0.37/gal. One other possibility, which is only speculation, is that the mix of gasoline and diesel being produced by refineries has been skewed toward higher volumes of gasoline production in recent months, which we explore in Fig. 5. The data is available from the US Energy Information Administration (EIA) here: https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=EMD_EPD2D_PTE_NUS_DPG&f=W.

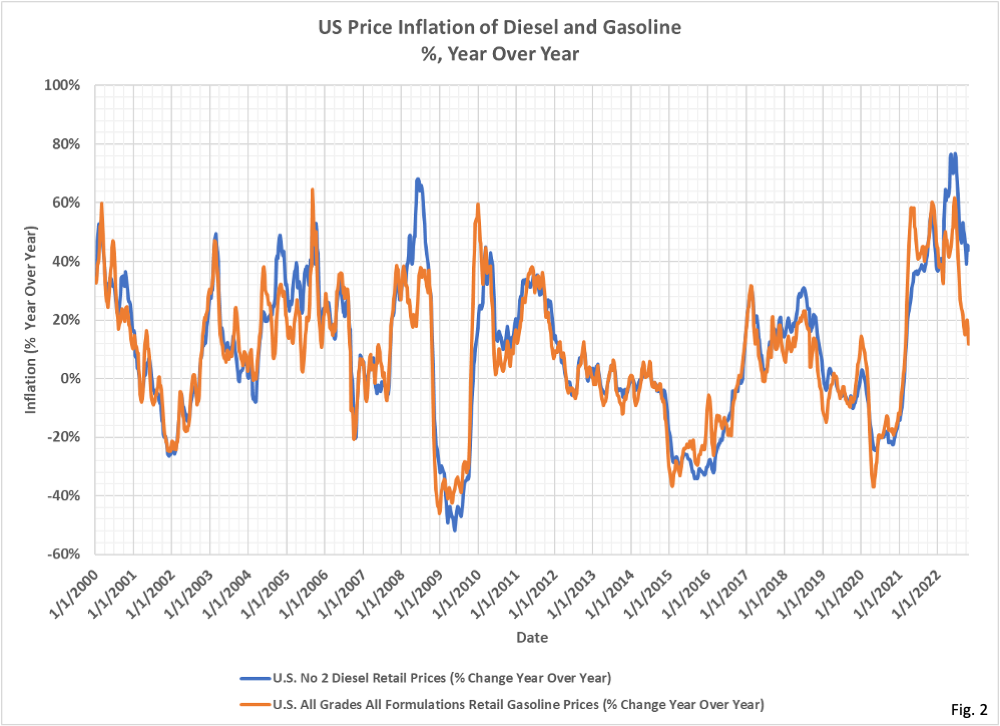

- Fig. 2, US Price Inflation of Diesel and Gasoline, Year Over Year: The annual inflation rate of diesel and gasoline has been the highest in the last 20 years in recent months. The annual rise in diesel prices has been greater than 20% since 3/22/2021, peaking at 76.8% on 6/20/2022, and recently falling to only 43.8%. The rise in gasoline prices has also been unprecedented, generally rising between 40% and 60% from 4/5/2021 to 7/22/2022, and recently dropping to 11.8%. While both diesel and gasoline have seen spikes of similar magnitude in the past 20 years, the past 2 years has seen sustained increases at a high rate over a long period of time.

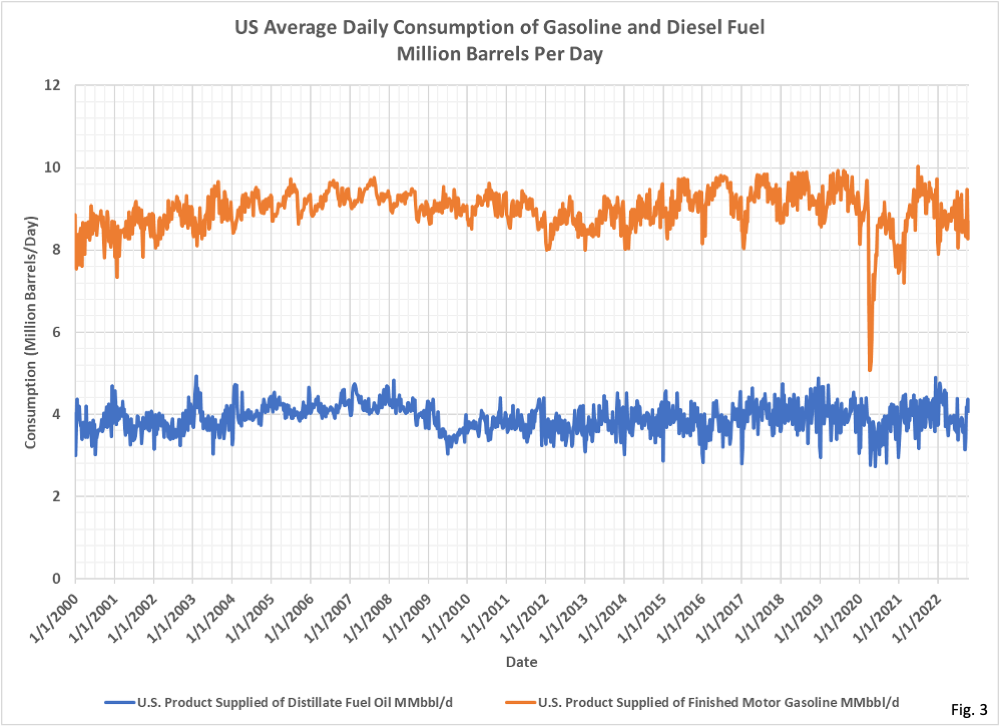

- Fig. 3, US Average Daily Consumption of Gasoline and Diesel: The consumption of diesel fuel was really quite stable from the 2009 recession up the start of the pandemic in 2020. There is definitely some seasonality of consumption throughout the year, and there was also generally higher consumption in 2017 and 2018, before dropping a little in 2019. After the pandemic, diesel consumption did not return to pre-pandemic levels until the end of 2021, and then has since dropped fairly significantly in 2022. Gasoline shows a similar pattern, dropping in 2022 and after peaking in mid-2021 after the pandemic. It seems from this chart that high demand is not the explanation for high diesel retail prices. The data is available from the EIA here: https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WDIUPUS2&f=W.

- Fig. 4, US Storage of Diesel and Gasoline: Some of the news articles and commentary have said that current storage levels of diesel are the lowest seen in decades. This is technically true, with current storage levels not having been lower since 2003. However, storage levels in 2012-2014 and 2018-2019 were not really substantially higher than the current level. However, it is possible that as the storage level falls to the 100 million barrel level, regional constraints and logistics challenges start to make supplies tight in certain areas of the country, and therefore tend to drive price higher. Storage data is available from the EIA here: https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WDISTUS1&f=W.

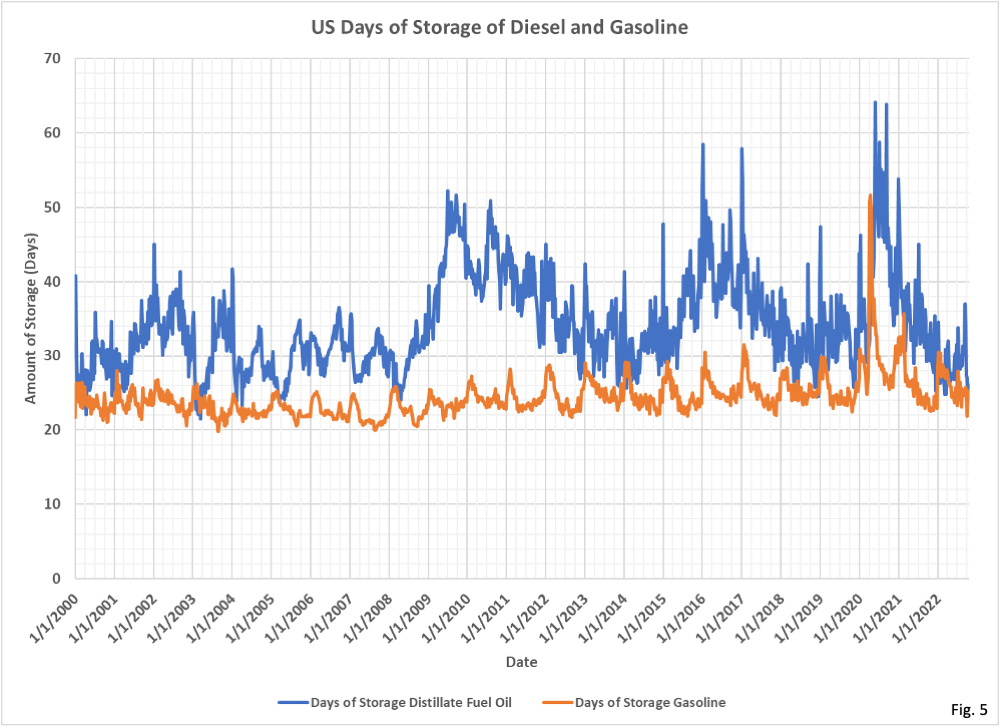

- Fig. 5, US Days of Storage: This chart displays how long it would take to completely drain the existing stored amount of diesel and gasoline, if production ceased and demand continued at the current rate. Diesel storage is at the 25 days level, as claimed in news article, which was also the case earlier this year as well as in 2013 and 2018, and was even a little lower in the early 2000’s. Again, this level of storage is not unprecedented, but perhaps what is unprecedented is the disruption to the refining and transportation industries, which may make this level of storage problematic when in years past it was not as much of a problem. The days of storage is calculated by dividing the storage amount from Fig. 4 by the consumption data from Fig. 3.

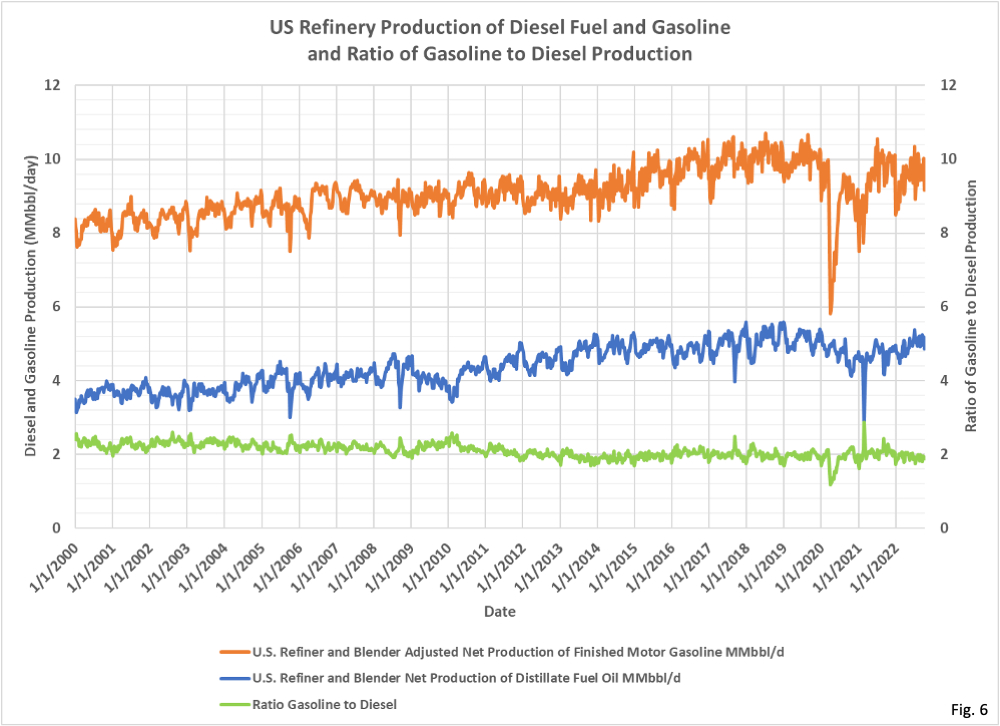

- Fig. 6, US Refinery Production of Gasoline and Diesel, and Ratio of Gasoline to Diesel Production: Shown here are US refinery production amounts since 2000. The production amounts were on a gradually rising trend up to the start of the Covid pandemic in 2022, while consumption was fairly flat as shown in Fig. 3. Gasoline production recovered to pre-pandemic levels in mid-2021 but have been somewhat lower in 2022. Meanwhile, diesel production is still a little below pre-pandemic levels. The ratio of gasoline production to diesel production has been slowly falling since 2000, meaning that proportionally less gasoline is produced per volume of diesel. This means that refinery mix is not responsible for reduced diesel production. The data is available from the EIA here: https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WGFRPUS2&f=W.

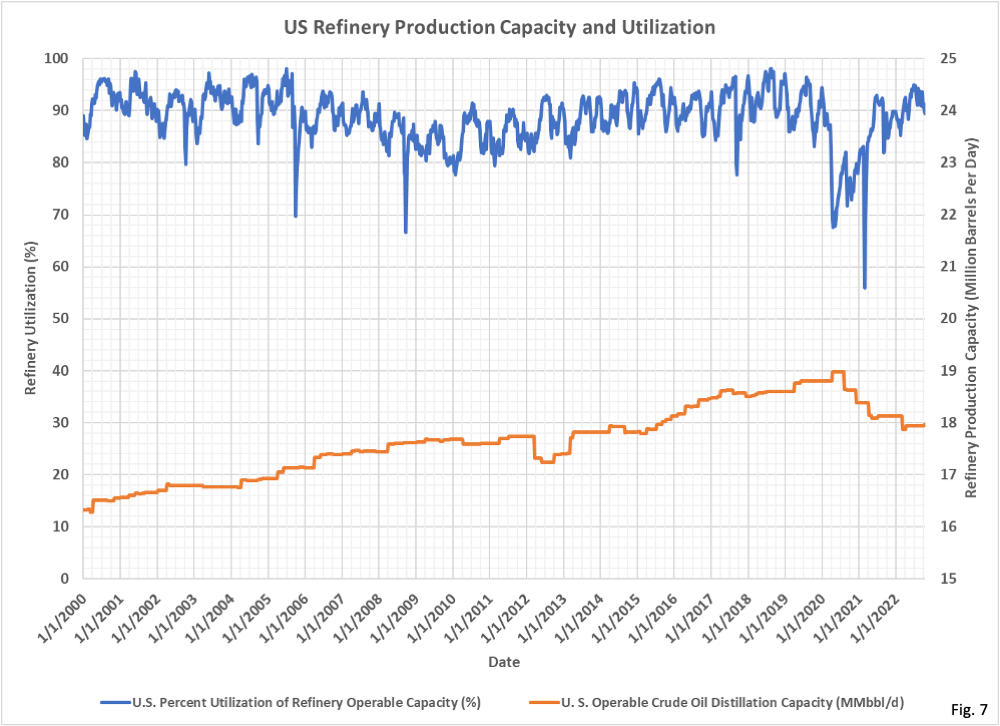

- Fig. 7, US Refinery Capacity: We have all heard discussion that no new refineries have been built in the US in the last 50 years, or something similar. This is true, but existing refineries have expanded capacity over time. This is the reason refinery capacity increased from 12 million barrels per day in 2000 to 19 million barrels per day in 2020. However, in 2020 and 2021, 6 US refineries closed. The largest was in Philadelphia, PA which had a major accident in 2019 (https://www.eia.gov/todayinenergy/detail.php?id=48636). Refinery utilization is roughly 90%, which is in line with historical levels. The data is available from the EIA here: https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WOCLEUS2&f=W.

- In summary, it appears that reduced overall refinery capacity has led to reduced production and storage amounts. This, perhaps combined with logistical bottlenecks that are aftereffects of the pandemic, may be responsible for the current price of diesel fuel and regional shortages. The continued pressure on refineries to reduce emissions, and the general animosity to hydrocarbon fuels by state and federal government agencies, cannot help the situation. Why would a refining company invest in capacity expansion projects, much less build a new refinery, when they are under attack? It seems likely that supply will continue to be constrained for the foreseeable future, perhaps leading to a situation where gasoline and diesel fuel will be imported.

RSS - Posts

RSS - Posts

Thanks for the fuel use plots. Special thanks to Dave. The storage days plot puts all the recent news on this issue in perspective. Yes, storage for Diesel and Gasoline is low but has not passed through the historic floor in storage of just over 20 days. If it hits 15 days then we can panic.