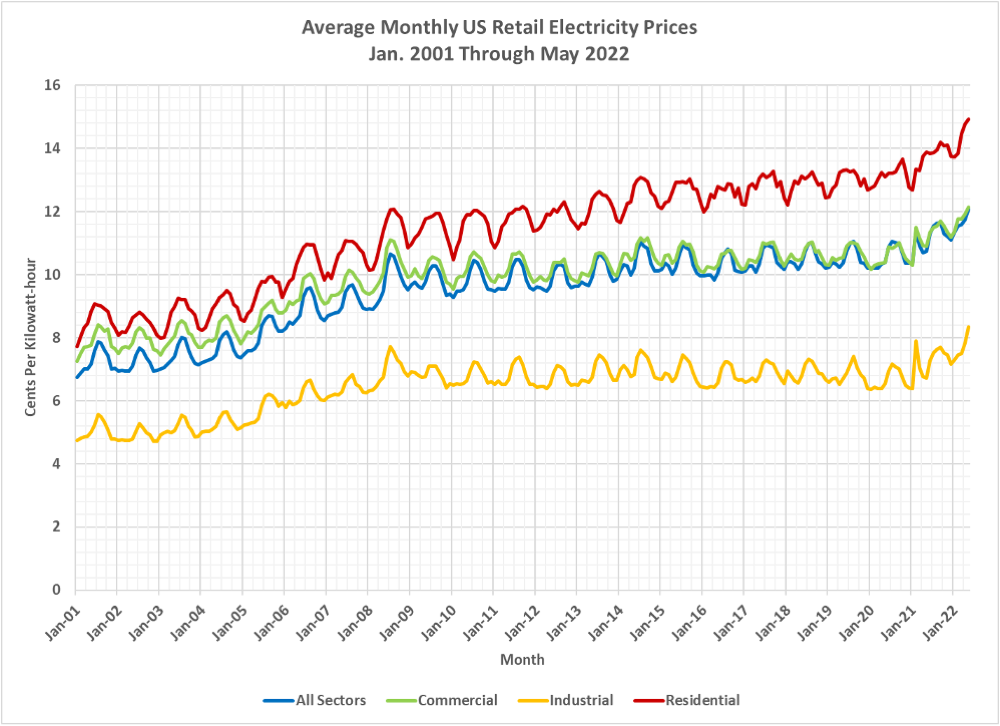

Consumers not only want to know that their electricity will always be there, but they want low prices with modest increases. Ain’t going to get either of those with renewables. It is hard to track recent residential rate increases, because they require approval by the state you live in, so they lag cost increases. In the next couple of years there will be big rate increases for electricity. But the chart below, put together by Dave Dixon, who is extremely familiar with this topic, shows the overall trend in electricity prices over the last two decades. You see the steady march upforward, with the recent leap, undoubtedly related to the current Presidementia’s infatuation with expensive, unreliable renewables. The early sharp increases were driven by oil crises or prices.

Dave’s notes:

Dave’s notes:

- The U.S. Energy Information Administration (EIA) publishes a wide variety of information. Here we are looking at retail electricity prices since 2001. The raw data is available here: https://www.eia.gov/

electricity/data/browser/#/ topic/7?agg=2,0,1&geo=g&freq= M&start=200101&end=202205& ctype=linechart<ype=pin& rtype=s&maptype=0&rse=0&pin=. - Fig. 1 displays the average US monthly retail price per kilowatt-hour of electricity. These values are plotted from the EIA data without modification. It is understandable perhaps that large industrial users of electricity would be able to negotiate lower prices. It is less clear why residential prices should have increased at a greater rate than either commercial or industrial prices. In Jan. 2001, the average residential price was 107% of the commercial price and 163% of the industrial price. In May 2022 the average residential prices was 123% of the commercial price and 179% of the industrial price. Clearly the average residential customer has experienced a higher rate of increase in prices since 2001.

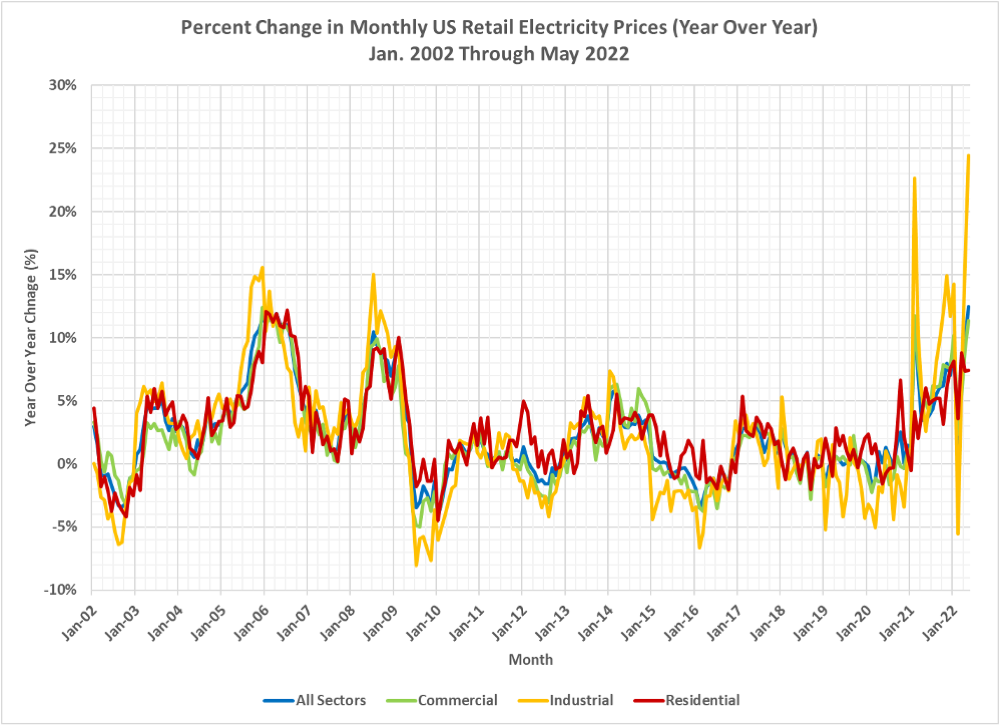

- Fig. 2 displays the rate of change in the average monthly price, year over year. We are calculating this change from the monthly price data displayed in Fig. 1. It appears that industrial customers are experiencing much more variability in prices than residential customers, which may partly explain why residential customers also have seen higher net change since 2001. The first very large positive spike in industrial prices was 22.7% in Feb. 2021. It is possible this was due to some after-effect of Covid shutdowns. This was followed one year later by a 5.6% decline in Feb. 2022. The most recent positive spike in industrial electricity prices was 24.4% in May 2022. This may be partly due to prices in May 2021 being abnormally low due to Covid disruptions, causing the year over year change to be inflated. However, if this spike is instead to due inflated costs in the electrical power industry then that will be tend to reinforce overall inflation trends. Note also that despite high overall inflation trends in 2022 that residential prices increased at a faster rate in 2006 and 2008/2009, at least so far.

Yikes!

PP&L killed their light industrial GS3 rate plan and put everyone back in the ‘market’. Our rates went form .06 to .12 in May … contracted for 3 years at .10 starting in 2023. Just passed it on in our price/# of product. You know 0% inflation last month …

PA is also restructuring their carbon credit shell game, not allowing PA utilities to buy them from out of state sources to meet the Green Weenie quotas. It’s going to get worse before it gets worse ! It’s not because they’re stupid, it’s because they know that the control of energy is the control of the country. They know full well that ‘renewables’ don’t have the energy density to match off with carbon based sources. If they put half the time/energy/money toward continued emissions improvements and efficiency upgrades, there would be no need for any of this bureaucratic nonsense. And, maybe we wouldn’t be selling our reserves to CHINA … so we can buy their solar panels and batteries.

It would be a very interesting discussion to understand how much of this Biden administration nightmare can be halted and/or overturned/reversed by a Republican led House and Senate in the fall. We’ll never make in to 2024 at this rate.

Natural gas and coal prices are sharply higher in the past year (and up even more from the early 2020 lows), as well.

Your electric bill will be much higher when you start to charge you new Electric Vehicle (EV).